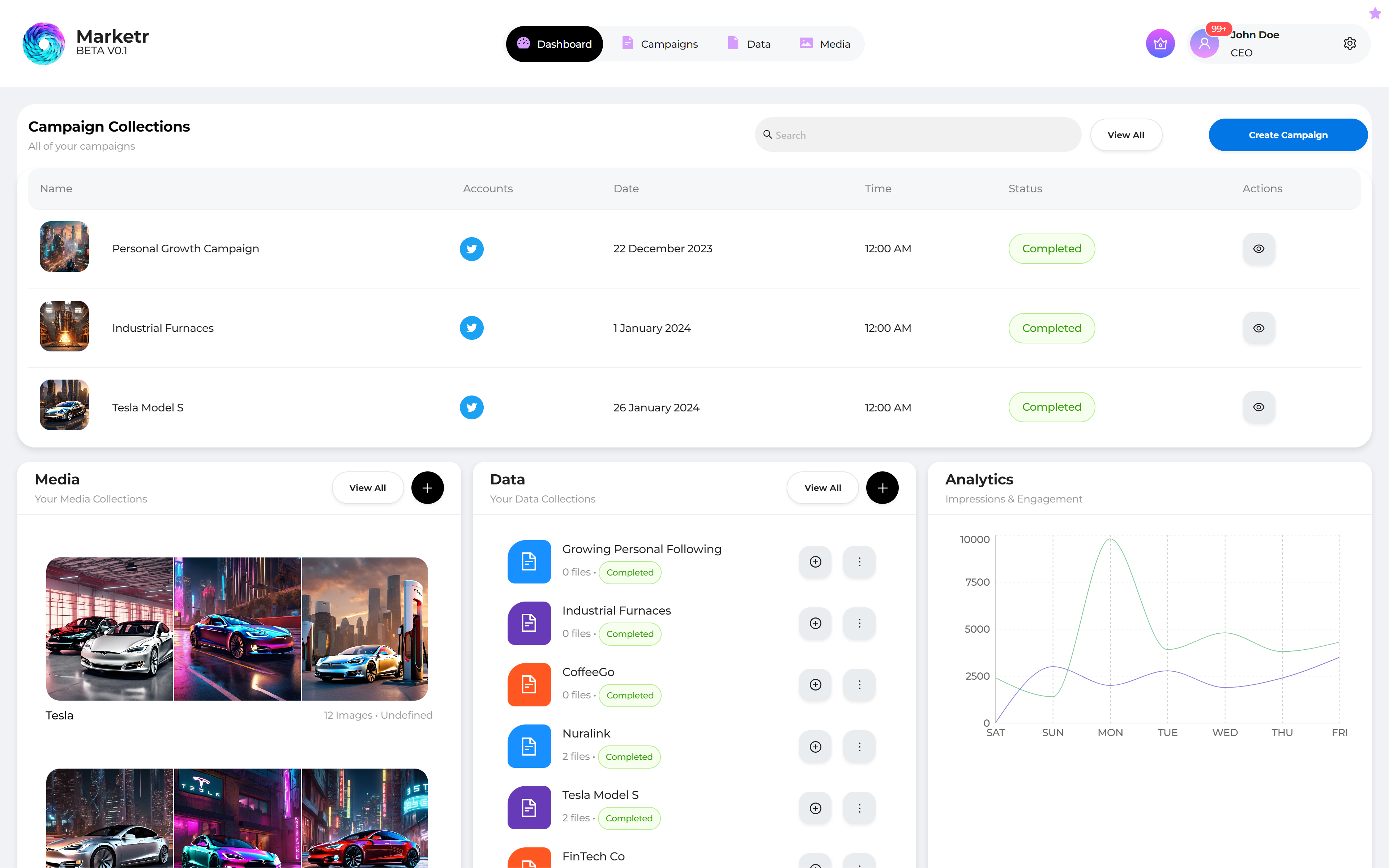

LinqAI is an innovative Artificial Intelligence (AI) solutions provider striving to transform the business landscape by integrating, optimizing, and automating processes for a smarter and more efficient future. Our proprietary AI bots streamline processes without altering your systems. We will carry out a Stealth Initial DEX Offering (IDO) to further enhance our services and provide additional benefits to our customers.

Token Overview

The $LNQ token, built on the Ethereum blockchain as an ERC-20 token, will be a key component of our ecosystem. The total supply will be 1 billion (1,000,000,000) $LNQ tokens, providing ample liquidity for our users and investors.

Token Contract

| Feature | Status |

|---|---|

| Contract Verified | YES |

| Contract Renounced | NO |

| Honeypot | NO |

| Buy Tax | 5% |

| Sell Tax | 5% |

| Proxy Contract | NO |

| Mintable | NO |

| Retrieve Ownership | NO |

| Balance Modifiable | NO |

| Hidden Owner | NO |

| Selfdestruct | NO |

| External Call Risk | NO |

| Tax Modifiable | YES (Tax will only ever decrease) |

| Transfer Pausable | NO |

| Blacklisted | NO |

| Whitelisted | NO |

| Antiwhale | NO |

| Antiwhale Modifiable | NO |

| Trading Cooldown | NO |

Token Tax

The purpose of having a token tax is to allow the project to bring in a small revenue from the buy and sell of tokens without having to liquidate tokens inorder to assist in funding the project. Many companies use this approach and it can lead to resentment in the community.

Our Buy & Sell tax will reduce over time in simple increments.

Tax Rewards

The tax is collected in a company wallet and every month 15% of all the tax revenue will be allocated back to use in EarnAI.

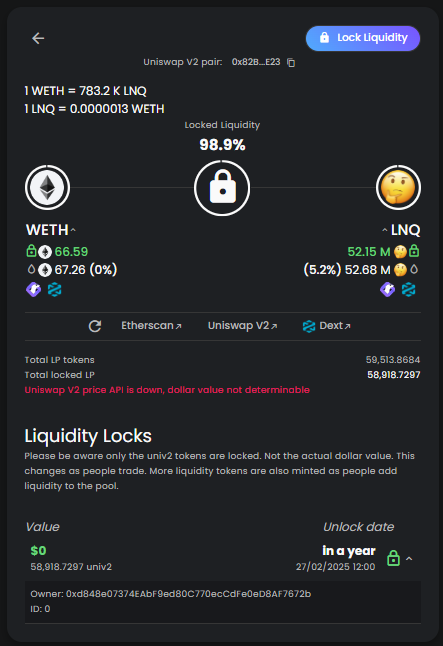

Liquidity

$LNQ/ETH - UniV2 Pair Link.

Uniswap V2 index 309202.

Token Economy

The $LNQ token will serve multiple functions within our ecosystem:

Unlocking Premium Tiers

The Top 100 token holders gain access to exclusive features within the LinqAI SaaS platforms. A tiered system ensures inclusivity, allowing top token holders to enjoy the tools of premium tiers for free. This enables dedicated community members to utilize the full suite of products that LinqAI will introduce to the market, without any charge. They also receive discounted access to events and other perks within the ecosystem

EarnAI

EarnAI by LinqAI integrates AI bots into B2B and B2C models through a SaaS subscription, ensuring continuous revenue and advancing AI technology. It uniquely employs a community-driven approach, allowing $LNQ token holders to direct monthly revenue towards token market increases, liquidity support, or farming resilience. The minimum requirement to participate in EarnAI is 100,000 $LNQ The program rewards longer-term commitments in its farming system, distributing tokens based on lock-in durations of 180, 90, and 60 days.

SaaS Subscription Discounts

Holders benefit from scaled discounts on subscription fees on all bots, proportionate to their token holdings. The discount tiers are structured to cater to a wide range of holders:

*If a holder is located within the Top 100 token holders as stated above then all SaaS tools are free and they receive a 100% discount

Voting Rights

Token holders are integral to the product development process, with a minimum of 100,000 $LNQ required for voting participation. The adoption of a weighted voting system ensures equitable representation, fostering a democratic environment within the ecosystem. Initially this will be the resource management of the EarnAI funds but in future will extend to much more.

Access Privilege

Investors holding at least 1,000,000 $LNQ are granted early access to alpha/beta versions and new product launches. This privilege extends to a wider investor base, inviting valuable feedback and fostering a sense of ownership and community. These community members will have a dedicated channel for comms with the internal team.

$LNQ - Company Wallet

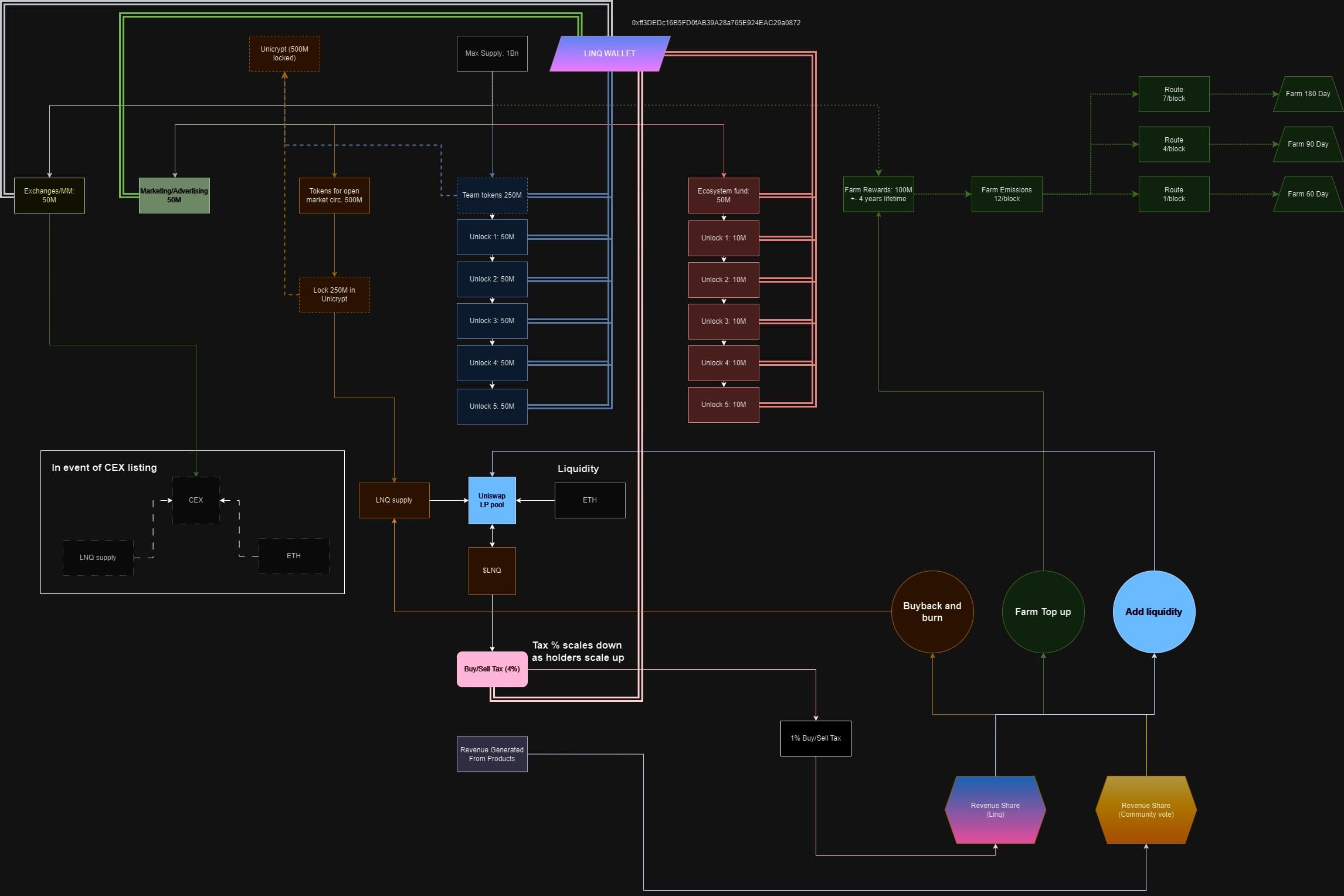

Token Sale & Distribution

The $LNQ tokens will be distributed through an IDO, with further details to be announced. We are committed to a fair and transparent distribution process that will provide opportunities for a wide range of participants.

Token Overview

Token Sale Rounds

Pre-seed Round:

Seed Round:

Private Round:

For all Sale Rounds the tokens will be locked for 50 days from the point of investment and distributed thereafter to the investor via token airdrop This system has been designed in order to stagger the token unlocks as well as reward the earliest investors.

Please note that the decision to conclude a funding round and progress to subsequent rounds rests solely at the discretion of our team. It is important to understand that completing a funding round is not a prerequisite for initiating the next one.

Additionally, our team reserves the right to either skip a planned funding round or conclude any ongoing round at any point, based on our strategic assessments.

We assure all our stakeholders that such decisions, whether to omit a round or close it prematurely, will in no way impact our existing investors. The integrity and security of invested funds are of utmost importance to us. To ensure transparency and security, all funds are safeguarded in a Multi-signature (Multi-sig) wallet. The details of this wallet are publicly available, allowing our investors to monitor their investments as they see fit.

Token Distribution

Notes

Token Unlocks

Max Supply - 1,000,000,000 $LNQ

Initial Lock Period

Post-token generation, the (850,000,000) tokens will be in a locked state (Unicrypt) ensuring no movement or transactions can be made.

*It is important to note that these will be unlocked in a linear fashion as stated below as to ensure a steady supply and demand of the token

Unlock Schedule

Monthly Linear Vesting

Farms

Introduction

Yield farming in cryptocurrency refers to the process of earning a return on capital by putting crypto assets to productive use in a decentralized finance (DeFi) market.

Investors, known as liquidity providers, stake or lock up their crypto assets in a liquidity pool, which is essentially a smart contract containing funds. In return, they earn rewards, typically in the form of additional cryptocurrency. These rewards can come from various sources, including interest from lenders, trading fees generated from the underlying DeFi platform, or other incentive mechanisms designed by the protocol.

Yield farming strategies often involve moving assets around between different pools to maximize return on investment, and this can require a high level of expertise and awareness of the associated risks, such as impermanent loss or smart contract vulnerabilities.

LinqAI will provide the ablility to hold your $LNQ in a yield farm that pays back a percentage APY dependant on how many tokens you lock away and which farm you chose to lock your tokens in.

Single Side Staking

Single-side staking in decentralized finance (DeFi) involves depositing a single type of cryptocurrency into a smart contract to earn rewards, unlike dual-asset liquidity pools. Users stake assets like Ethereum (ETH) or a native token for various purposes, including transaction validation or providing liquidity.

This staking offers rewards such as additional tokens or interest, with the rate depending on the protocol. Benefits include reduced risk of impermanent loss and potential governance rights in the DeFi platform.

Liquidity Pool Staking

$LNQ, launched on the Ethereum blockchain, can be paired with Ethereum (ETH) to create a liquidity pool in the DeFi ecosystem. This pool, based on smart contract balances of LNQ and ETH, allows users to exchange these tokens.

Liquidity providers contribute LNQ and ETH, earning rewards like transaction fees and potential yield farming or staking incentives. Automated Market Makers (AMMs) facilitate trading within the pool. However, providers should be mindful of risks such as impermanent loss and smart contract vulnerabilities.

Impermanent Loss

Impermanent loss in decentralized finance (DeFi) occurs when the price of assets in a liquidity pool changes compared to when they were deposited. This typically happens in pools with two or more assets, like Ethereum and a token. As the relative value of these assets shifts, the pool's asset ratio changes, potentially leading to a loss for liquidity providers when they withdraw their assets. This loss is 'impermanent' because it's only realized if the provider withdraws the assets; if the prices return to their original ratio, the loss can be reversed. Despite earning transaction fees, liquidity providers must be aware of this risk, especially in volatile markets.

LinqAI Farms

Initially LinqAI will only be providing Single Side Staking Farms to its token holders (see below). However you are still able to create LP tokens on Uniswap where you will earn a small percentage of each trade that occurs on the blockchain for $LNQ.

We recommend that you only take part in purcahsing LP tokens if you understand what you are doing and you know the risks of Impermanent Loss (see above)

Every 15 seconds 20 tokens are allocated to the 3 farms as rewards. The breakdown of those 20 tokens are as follows:

In short, the longer you lock away your tokens for the higher the rewards proportion, because this encourages a lower circulating supply which supports token health.